south dakota used vehicle sales tax rate

There are four reasons that products and services would be exempt from South Dakota sales tax. Municipalities may impose a general municipal sales tax rate of up to 2.

What S The Car Sales Tax In Each State Find The Best Car Price

The 2018 United States Supreme Court decision in South Dakota v.

. With local taxes the total sales tax rate is between 4500 and 7500. Pin On Hot Sellers Did South Dakota v. Anytime you are shopping around for a new vehicle and are beginning to make a budget its important to factor in state taxes titling and registration fees vehicle inspectionsmog test costs and car insurance into your total cost.

All car sales in South Dakota are subject to the 4 statewide sales tax. The Jacksonville Florida general sales tax rate is 6. South Dakota has recent rate changes Thu Jul 01 2021.

To review the rules in South Dakota visit our state-by-state guide. Calculate By ZIP Codeor manually enter sales tax South Dakota QuickFacts. The Fall River County sales tax rate is.

Yes you must pay sales tax when you buy a used car if you live in a state that has sales tax. Jacksonville FL Sales Tax Rate. Yes you can but you wont be allowed to operate it in South Dakota under any circumstances.

Its important to note that this does include any local or county sales tax which can go up to 35 for a total sales tax rate of 75. 45 The following tax may apply in addition to the state sales tax. Subject to the sales and use tax based on the lesser of 5 of the total lease payments plus other charges or 300.

View pg 1 of chart find total for location. However you do not pay that tax to the individual selling the car. South dakota sales tax on vehicles 22.

The South Dakota Department of Revenue administers these taxes. How to Calculate Sales Tax on a Car in South Dakota. Car sales tax in South Dakota is 4 of the price of the car.

If a motor vehicle lease contract does not exceed 90 continuous days the 300 maximum tax does not apply and the lease is subject to the sales and use tax at a rate of 6 plus the applicable local sales tax rate. So whilst the Sales Tax Rate in South Dakota is 4 you can actually pay anywhere between 45 and 65 depending on the local sales tax rate applied in the municipality. 4 Motor Vehicle Excise Manual.

Mobile Manufactured homes are subject to. Sale of 20000 motor vehicle to a resident of another state where the sales tax rate on motor vehicles is seven percent. Can I import a vehicle into South Dakota for the lone purpose of repair or modification.

Out-of-state vehicle titled option of licensing in the corporate name of a licensed motor vehicle dealer according to 32-5-27. South dakota vehicle sales tax rate Thursday February 24 2022 Edit Review and renew your vehicle registrationdecals and license plates purchase new license plates opt-in for email renewal and general notifications find out the estimated renewal cost of your vehicles report the sale of a vehicle and print a sellers permit. Registration fees in South Dakota are based on the type age and weight of the vehicle.

3113 YES but not from the Title Ad Valorem Tax Fee NO A 4 sales tax rate will still be imposed. The South Dakota sales tax and use tax rates are 45. Has impacted many state nexus laws and sales tax collection requirements.

Select the South Dakota city from the. 400 South Dakota State Sales Tax -200 Maximum Local Sales Tax 200 Maximum Possible Sales Tax 583 Average Local State Sales Tax. However the average total tax rate in South Dakota is 5814.

In the state of South Dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer. The highest sales tax is in Roslyn with a combined tax rate of 75 and the lowest rate is in Buffalo and Shannon Counties with a combined rate of 45. The South Dakota vehicle registration cost calculator is only an estimate and does not include any taxes fees from late registration and trade in fees.

What Rates may Municipalities Impose. The South Dakota state sales tax rate is currently. You pay the states excise tax 4 of the vehicles purchase price only when registering a vehicle for the first time after a recent purchasechange of ownership.

All brand-new vehicles are charged a 4 excise tax in the state of South. Several examples of of items that exempt from South Dakota sales tax are prescription medications farm machinery advertising services replacement parts and livestock. 4 State Sales Tax or Use Tax Applies to all sales or purchases of taxable products and services.

450 How do I pay sales tax on a car. This means that an individual in the. You will pay it to your states DMV when you register the vehicle.

Any titling transfer fees. Arkansas plus. 56 county city.

South Dakota Taxes and Rates Motor Vehicle Excise Tax Applies to the purchase of most motor vehicles. This calculator can help you estimate the taxes required when purchasing a new or used vehicle. December 2020 in Allgemein by.

South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax. 31 rows The state sales tax rate in South Dakota is 4500. This is the case even when the buyers out-of-pocket cost for the purchase is 10800.

Different areas have varying additional sales taxes as well. The state sales tax rate in South Dakota is 4500. However the buyer will have to pay taxes on the car as if its total cost is 12000.

Municipal Sales Tax or Use Tax. Select Community Details then click Economy to view sales tax rates. Moreover what is South Dakota sales tax.

7 local rate on first 1600 275 single article tax on second 1600 to 3200 total. A title transfer fee of 1000 will apply.

Car Sales Tax In North Dakota Getjerry Com

How Do State And Local Sales Taxes Work Tax Policy Center

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

Taxes And Spending In Nebraska

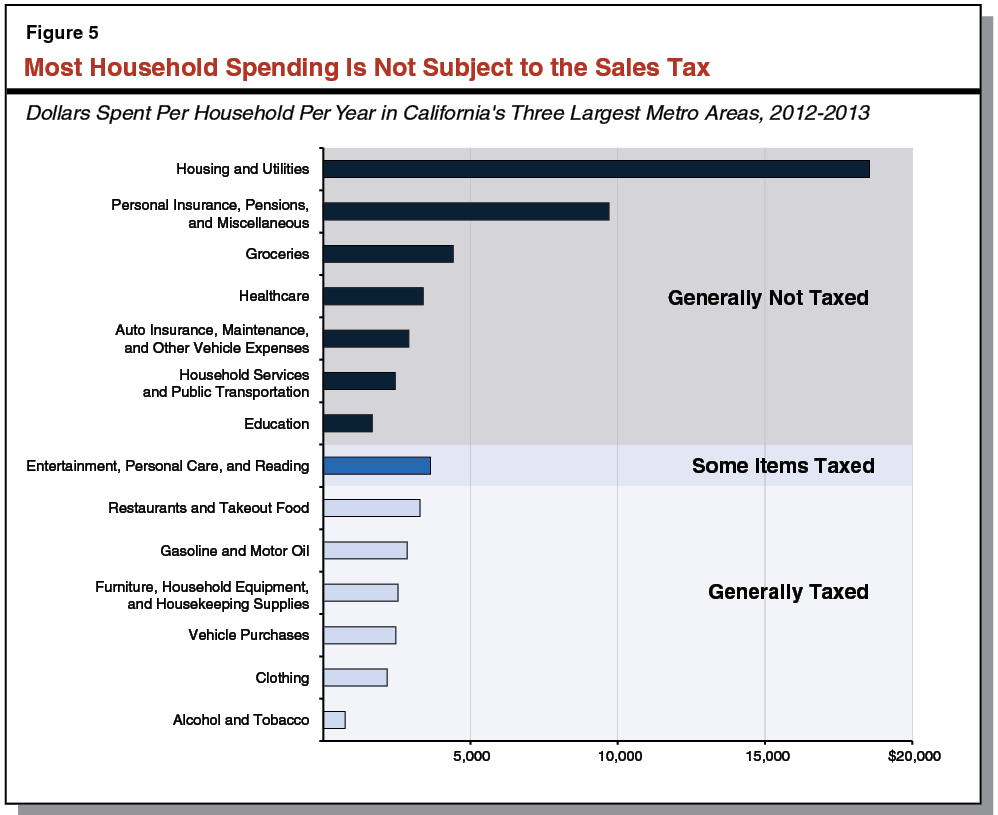

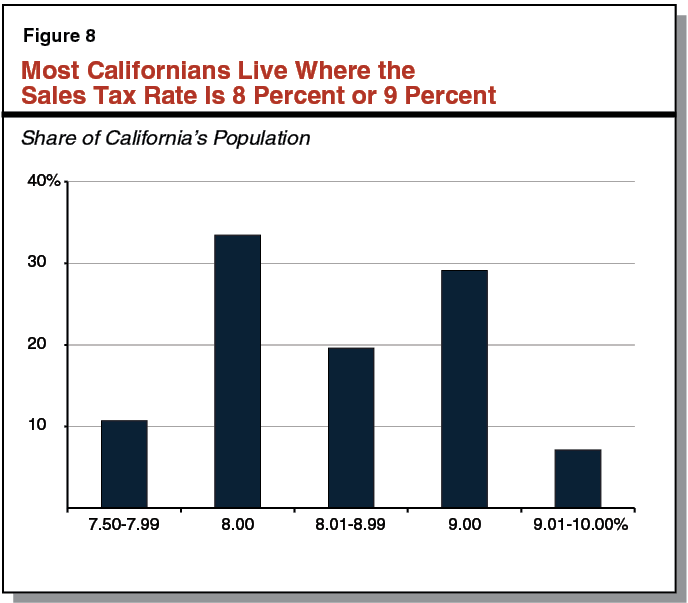

Understanding California S Sales Tax

South Dakota Sales Tax Small Business Guide Truic

What S The Car Sales Tax In Each State Find The Best Car Price

How Do State And Local Sales Taxes Work Tax Policy Center

Understanding California S Sales Tax

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Understanding California S Sales Tax

Sales Taxes In The United States Wikiwand

Sales Tax On Cars And Vehicles In South Dakota

States With No Sales Tax On Cars

Sales Taxes In The United States Wikiwand